JG Chemicals launched its Initial Public Offer (IPO) today. The Initial Public offer opened for subscription for 3 Days i.e. until March 7, 2024. The company will raise upto Rs. 251.2 crore through this IPO and its a combination of a fresh issue size of Rs 165 crore and an offer for sale of Rs 86.19 crore. The price band is fixed in the range of Rs 210-221 per share.

Issue Details

| ISSUE OPENS | 5 MARCH 2024 |

| ISSUE CLOSES | 7 MARCH 2024 |

| ISSUE PRICE | Rs 210-221 PER SHARE |

| FRESH ISSUE | Rs 165 crore |

| OFFER FOR SALE | Rs 86.2 crore |

| TOTAL ISSUE SIZE | Rs 252.1 crore |

| LISTING | BSE AND NSE |

JG Chemicals IPO Allotment Date and Status

The allotment of shares under the IPO JG Chemicals is to be finalized on 11 March 2024

JG Chemicals IPO Listing Date

Expected listing date of JG Chemicals on NSE and BSE will be 13 March 2024

JG Chemicals IPO Lot Size

The minimum lot size for retail investor is 67 shares and the minimum amount of investment is Rs 14,807

JG Chemicals IPO Lead Managers and Registrar

Keynote financial services, Emkay Global Services and Centrum Capital are the lead managers of JG Chemicals IPO. Kfin Technologies limited is the registrar of JG Chemicals IPO.

JG Chemical Business Model

JG Chemicals, renowned as the leading zinc oxide manufacturer, commands an impressive 30% market share in both production and revenue. Boasting a portfolio of over 80 grades of zinc oxide, the company stands tall among the top ten global manufacturers. Its products find applications across diverse industries, from rubber and ceramics to pharmaceuticals and electronics. With an extensive clientele, including 200 domestic customers and over 50 global counterparts spanning 10 countries, JG Chemicals is poised for a stellar IPO debut.

JG Chemicals Financial Overview

| YEAR | REVENUE (in crore) | EXPENSE (in crore) | PAT (in crore) |

|---|---|---|---|

| 2021 | Rs 407.27 | Rs 388.16 | Rs 13.95 |

| 2022 | Rs 440.40 | Rs 399.20 | Rs 28.80 |

| 2023 | Rs 623.05 | Rs 565.60 | Rs 43.13 |

JG Chemicals Listing Dates and Allotment

| IPO OPEN DATE | 5 MARCH 2024 |

| IPO CLOSE | 7 MARCH 2024 |

| ALLOTMENT | 11 MARCH 2024 |

| REFUND | 12 MARCH 2024 |

| CREDIT TO DMAT | 12 MARCH 2024 |

| LISTING DATE | 13 MARCH 2024 |

JG Chemicals Price Band Details

| IPO SIZE | Rs 251.19 crore approx. |

| FRESH ISSUE | Rs 165 crore approx. |

| OFFER FOR SALE | 11,366,063 EQUITY SHARES approx |

| FACE VALUE | Rs 10 per share |

| RETAIL QUOTA | 35% |

| QIB QUOTA | 50% |

| NII QUOTA | 15% |

| DRHP PROSPECTUS | CHECK HERE |

| ANCHOR INVESTERS LISTS | CLICK HERE |

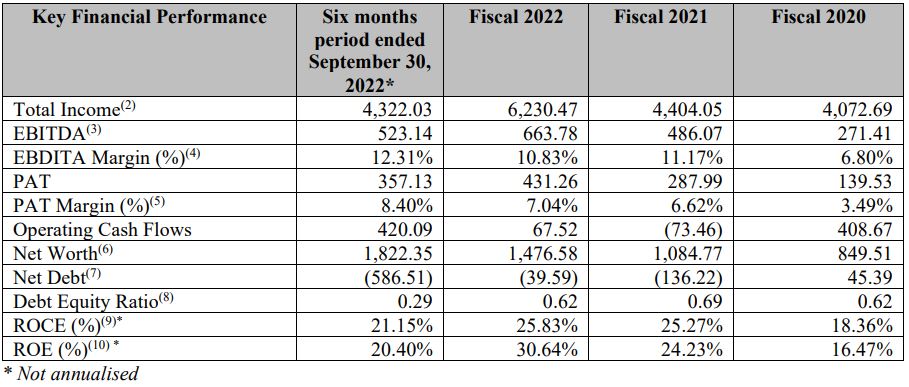

JG Chemical Key Financial Performance

Objects of the Offer Declared by JG Chemicals

| Particulars | Amount (in ₹million) |

|---|---|

| Repayment or Pre-payment in full or in part, of all or certain borrowings availed by Company Material Subsidiary | 450.00 |

| Funding capital expenditure requirements for setting up of a research and development Centre situated in Naidupeta | 53.14 |

| Funding long-term working capital requirements | 650.00 |

| Funding long-term working capital requirements of Company | 350.00 |

JG Chemicals Board of Directors

| Name | Designation |

|---|---|

| Suresh Jhunjhunwala | Executive Chairman and Wholetime Director |

| Anirudh Jhunjhunwala | Managing Director and CEO |

| Anuj Jhunjhunwala | Whole-time Director and CFO |

| Ashok Bhandari | Independent Director |

| Sukanta Nag | Independent Director |

| Savita Agarwal | Independent Director |

Registrar to the Offer

KFin Technologies Limited

Selenium, Tower B, Plot No. 31 and 32 Financial District,

Nanakramguda, Serilingampally Hyderabad,

Rangareddi 500 032, Telangana, India

Telephone: +91 40 6716 2222

Toll Free No.: 18003094001

E-mail: jgchemicals.ipo@kfintech.com

Website: www.kfintech.com

Investor grievance e-mail: einward.ris@kfintech.com

Contact Person: M. Murali Krishna

SEBI registration number.: INR000000221

CIN: U72400TG2017PLC117649